When the amounts and the number of transactions increase, the amounts paid at the border will of course also be higher.

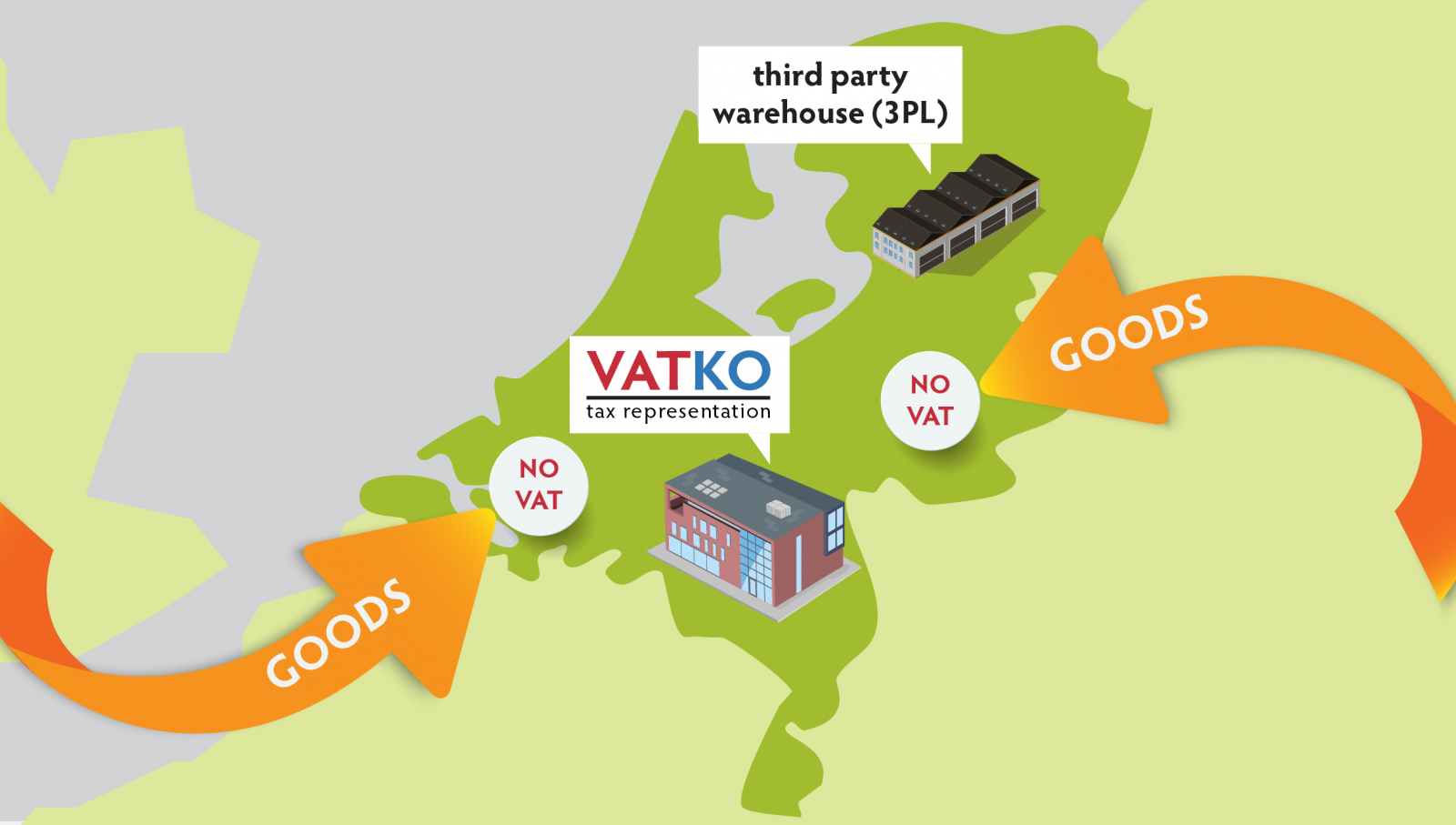

By choosing to make use of a tax representative, at the border no VAT is required.

This will also imply that in almost all the cases of B2B deliverance no VAT payments come into view.

From a financial point of view, a pleasant arrangement.